The 2023 financial year was characterised by a fall in gas demand, due mainly to higher temperatures. In this context, Madrileña Red de Gas continues to demonstrate significant capacity for financial adaptation. The year ended with a total of 908,810 supply points, of which 904,606 were for natural gas and 4,204 for LPG.

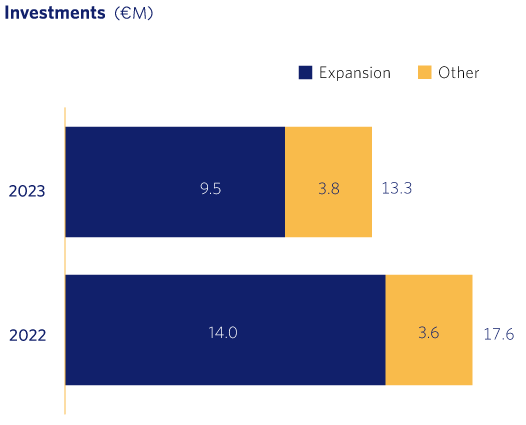

Madrileña Red de Gas has invested €9.5 million in extending its distribution network, providing households, industry and businesses with access to a highly efficient fuel through a continuous and reliable supply.

This is the third year of the regulatory period (2021-2026) in which gas years are set, which differ from the calendar year.

6.1 Summary of results

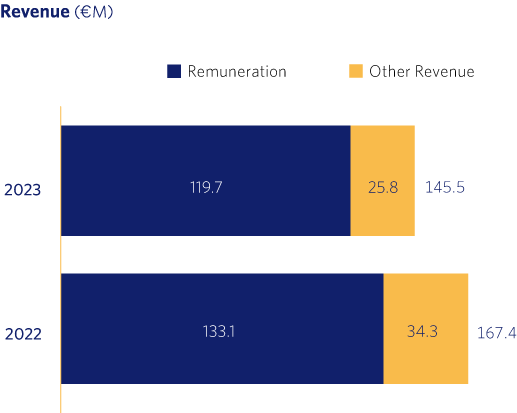

| €M | 2022 | 2023 | 1 Excluding non-recurring expenses. |

| Remuneration | 133.1 | 119.7 |

| Other revenues | 34.3 | 25.8 |

| EBITDA1 | 130.4 | 114.3 |

| EBIT | 97.2 | 84.4 |

| Net profit | 90.1 | 56.1 |

Madrileña Red de Gas has implemented numerous initiatives and projects that have led to excellent growth results, both in terms of investment in infrastructures, with the construction of new networks, and in the acquisition of new supply points.

However, as reported by the gas system operator (ENAGAS), total natural gas consumption in 2023 reached 325.4 TWh, 10.7% less than in 2022, due to lower electricity consumption.

This means a slight decrease in the company’s financial results, due to the decrease in revenues caused by the reduction in consumption, caused by the increase in temperatures, the high price of gas and the penetration of new energy technologies.

According to the quarterly reports published by the National Commission on Financial Markets and Competition (CNMC) for 2023, Madrileña Red de Gas has become the gas distributor with the most active supply points in the Community of Madrid

The company obtained revenues of €145.5 million, 13% lower than the previous year, mainly due to lower gas demand as a result of higher temperatures and regulatory cutbacks.

The main activity of Madrileña Red de Gas – the distribution of natural gas – is a regulated activity, with regulatory periods spanning six years. The 2023 financial year was the third year of the regulatory period 2021-2026, in which the gas year closed on 30 September.

Remuneration of the distribution activity is the company’s main source of revenue, calculated annually on the basis of a parametric formula, and which varies according to the growth in supply points and the demand for gas transported through the network.

According to the quarterly reports published by the National Commission on Financial Markets and Competition (CNMC) for 2023, Madrileña Red de Gas has become the gas distributor with the most active supply points in the Community of Madrid.

At the close of 2023, Madrileña Red de Gas distributed gas to 908,000 supply points, of which 885,000 are for natural gas. The company’s growth strategy continues to focus on profitable and sustainable expansion in its operating territory.

Other pillars underpinning its growth strategy are the company’s efforts to address the risks and opportunities presented by the necessary energy transition. In the case of Madrileña Red de Gas, it is linked to the distribution capacity of renewable gases, such as hydrogen and biogas, as well as new energy solutions such as aerothermal and geothermal energy.

The future extension of the network and the company’s ability to maintain a share of active supply points are linked to the development of its investment and technical capabilities in this line of innovation and development.

6.2 Operating results

EBITDA for 2023 amounted €114.3 million, 12.3% lower than the previous year. Revenues fell by 13%, which is the main cause of the drop in EBITDA.

6.3 Revenue

The company obtained revenues of €145.5 million, of which €142.3 million came from the natural gas business, while the remaining €3.2 million originated from the LPG business.

Within the natural gas business, 84% was contributed by the regulated remuneration for the distribution activity, made up of the figure set by the CNMC Resolution of 19 May 2022 and 30 May 2023, and the best estimate of the remuneration made by the company’s senior management.

The remaining 16% refers to other services related to the natural gas distribution activity, such as the rental of meters, scheduled inspections and other services offered to consumers.

6.32 Financial position and balance sheet

Financial strength is an essential pillar of the MRG strategy. The company has strong levels of solvency and liquidity that are consistent with an investment grade rating. The financial structure is efficient for the long term.

For the 2023 financial year, the gross debt amounts to €226.8 million, and this debt matures in 2027.

The company also has a contingent credit line, amounting to €75 million, renewed in February 2024 until February 2027 and aligned with the company’s real needs for the coming years.

Dividend flexibility is another feature that gives the company a better financial position.

The debt of the group is issued by MRG Finance, B.V. in the regulated Luxembourg market under the EMTN Programme.

This debt is classed as investment grade (BBB-) by the S&P rating agency, and classed as BBB (low) by DBRS.

| Balance sheet (€M) | 2022 | 2023 |

| Gas distribution licences & other intangibles | 751.0 | 751.0 |

| Net tangible fixed assets | 294.9 | 279.1 |

| Total network fixed assets | 1,045.9 | 1,030.1 |

| Goodwill | 57.4 | 57.4 |

| Deferred tax assets | 12.4 | 7.8 |

| Other non-current assets | 7.8 | 2.8 |

| Current assets | 35.5 | 47.1 |

| Cash | 16.2 | 58.3 |

| Total assets | 1,175.2 | 1,203.5 |

| Equity | 752.8 | 789.2 |

| Long term debt | 1.8 | 1.8 |

| Deferred income tax liabilities | 92.0 | 100.7 |

| Other non-current liabilities | 260.2 | 258.2 |

| Current liabilities | 68.4 | 53.6 |

| Total liabilities & shareholders equity | 1,175.2 | 1,203.5 |

6.5 Cash flow from operations

Operating cash flow was €86.3 million, compared with €96.1 million in the previous year. The reduction in EBITDA, largely attributable to lower demand and variations in gas system balances in 2023 compared with 2022, helps explain this variation.

As of 31 December 2023, the system deficit position was higher than the system deficit position for the same period in 2022, reducing the cash flow by €8 million compared with the previous year.

| Free cash flow (€M) | 2022 | 2023 |

| EBITDA | 130.4 | 114.4 |

| Income tax paid | -5.2 | -3.7 |

| Working capital | -11.5 | -11.1 |

| Capex | -17.6 | -13.3 |

| Free cash flow/td> | 96.1 | 86.3 |

6.6 Investments

Over the course of 2023, investments totalled €13.3 million, compared with €17.6 million in 2022. The company maintains the same level of investment in its own networks and in other projects. Conversions of LPG supply points to natural gas were lower than in the previous year, in line with the remaining volume of LPG supply points to be converted. Investment in third party networks was also lower. Regarding their purpose, these can be classified into the following groups:

Expansion

Madrileña Red de Gas invested a total of €9.5 million, of which €6.5 million were allocated to the expansion of the natural gas distribution network, and €3 million were allocated to the plan to transform LPG to natural gas.

Other projects

Investments remain at a level comparable to the previous year, and are geared towards network maintenance, fraud prevention, digitalisation and the development of information systems.

This is done in order to achieve cost efficiency and improve the quality of customer service.